The China distortion: Why brands are misreading the luxury slowdown

By Daniel Langer, originally published in Jing Daily

Chinese consumers have not stopped spending. They’ve just stopped spending in the way global brands expect them to.

Over the last few weeks, I’ve had countless interviews with major global media outlets about the state of luxury in China.

After years of being the reliable engine of double-digit growth, the market seems to have stalled. Quarterly reports from major conglomerates are filled with euphemisms like “headwinds” and “softening demand.” The prevailing sentiment in boardrooms is confusion. Executives are asking why the Chinese consumer has stopped spending.

This is the wrong question. The Chinese consumer has not stopped spending. They have stopped behaving in the way Western brands expect them to.

We are witnessing a fundamental misunderstanding of current market dynamics. The data appearing in recent reports, showing negative growth in mainland China, is being misinterpreted as a catastrophic collapse of desire. In reality, it is a structural correction of four specific anomalies that distorted the market over the last five years.

Brands that fail to recognize this distinction are making strategic errors that will cost them their future relevance in the region.

The repatriation mirage

The first misconception is the baseline itself. Between 2020 and early 2023, the Chinese luxury market experienced an artificial super-cycle. Due to strict quarantine measures and the cessation of international travel, luxury consumption was forcibly repatriated. Spending that would have normally occurred in Paris, Milan, New York, or Tokyo was trapped within mainland China.

This produced spectacularly inflated domestic growth figures that many brands mistook for a new normal. After the pandemic, everyone was talking about “revenge spending” without fully grasping the underlying dynamics.

Since 2023, travel restrictions have been lifted, and Chinese consumers are mobile again. Consequently, we are seeing a massive recalibration as consumption shifts back to international hubs. The perceived decline in domestic China sales is, in part, simply the market returning to its natural state of global fluidity. Brands looking at their China profits and losses in isolation are missing the bigger picture: the wallet share is not necessarily vanishing; it is moving.

The maturity reality check

The second fallacy is the expectation of perpetual double-digit growth. For two decades, China was an emerging market. It is now a mature one. The days of easy growth, when brands could simply open more stores in Tier 2 and Tier 3 cities and ride the rising tide, are over.

This maturity is compounded by a sobering economic reality. China’s real estate crisis has fundamentally altered the psychology of wealth. For years, property served as the primary store of value for the country’s middle and upper classes. With that asset class under immense pressure, the feel-good factor that once fueled aspirational spending has widely evaporated.

Consumers are no longer buying luxury to project status in a booming economy. Instead, they are scrutinizing purchases through a lens of financial prudence.

The focus on investment value

This brings us to the most critical shift: from consumption to investment. In a climate of economic uncertainty, the definition of luxury has changed. Clients are moving away from in-the-moment fashion choices and toward long-term assets.

This explains why certain segments, specifically high-end jewelry and investment-grade leather goods from brands like Hermès, remain resilient, while many aspirational fashion brands falter. The Chinese consumer is increasingly sophisticated, evaluating purchases through the lens of resale value and longevity. If a brand cannot prove that its products will hold value, it is dismissed.

Many brands that neglected clear brand storytelling and long-term extreme value creation are not only paying a steep price today; they have already lost the confidence of Chinese shoppers for the future.

Additionally, luxury purchases are also moving from hard goods to experiences. During the pandemic, consumers bought products because they couldn’t buy memories. Now, the experience economy is reclaiming its share of wallet. As a result, many companies that sell physical goods and benefited from a one-time pandemic windfall are feeling the shift.

The rise of cultural confidence

Finally, Western brands are facing a new competitor: China itself. The era in which “Western” automatically equated to “superior” is over.

Just look at the German car industry. As early as 2019, I warned of a significant shift in consumer preferences toward Chinese brands. At that time, many car managers dismissed the signals and relied on the assumption of never-ending demand. Today, they’re paying the price for that complacency.

The surge in Guochao (national trend) is not just a fad but a permanent shift in consumer identity. Local brands are capturing market share because they offer better cultural relevance, faster innovation, and a deeper understanding of the local digital ecosystem.

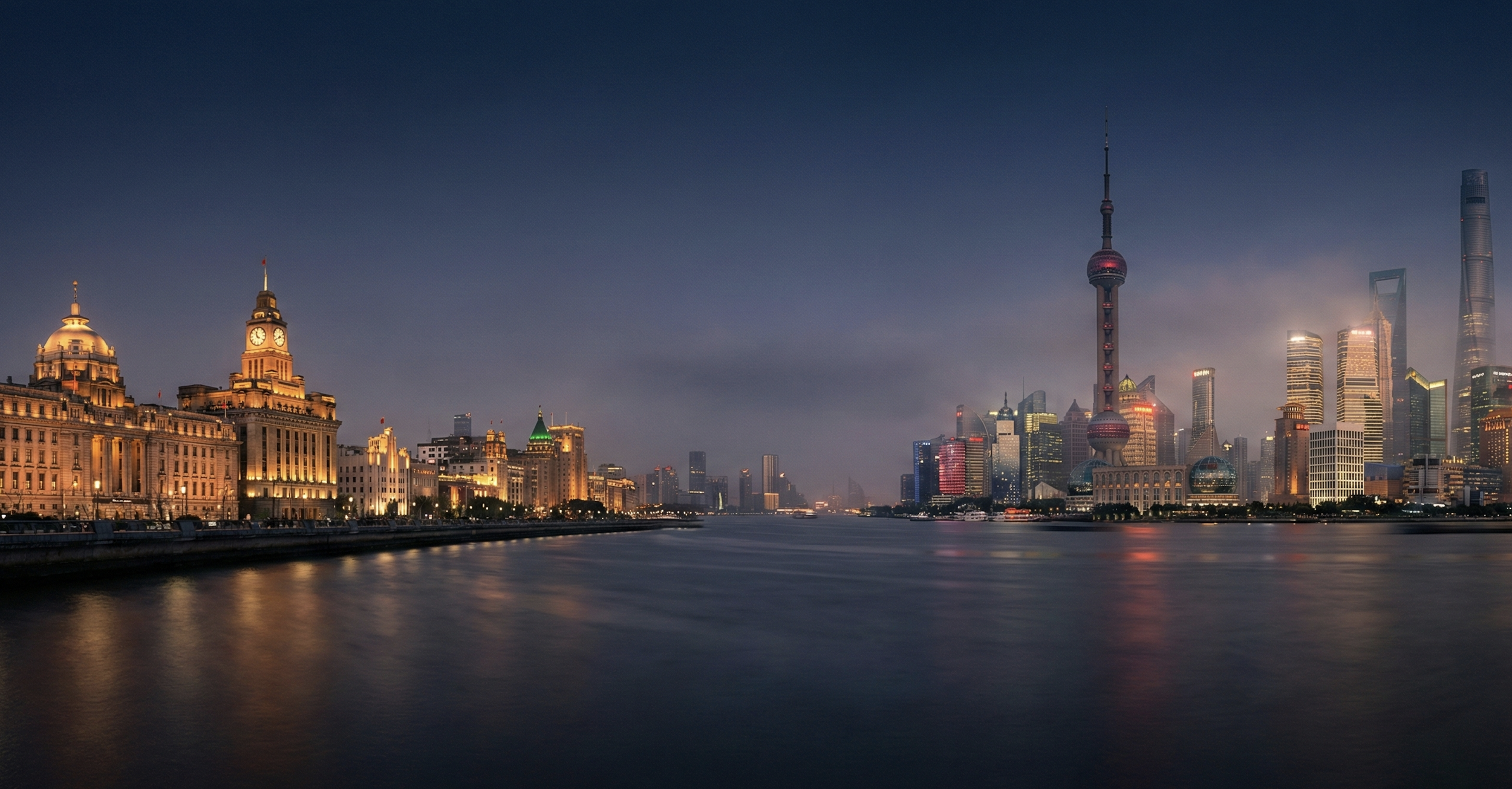

During a recent visit to Shanghai, I saw that Anta, the Chinese sportswear giant, prominently featured the Chinese flag on much of its merchandise. Local brands are creating cultural capital and desire. In contrast, many Western brands continue to treat China as a remote ATM, exporting generic global campaigns without deep localization. They are becoming irrelevant. To investors, they call it “headwinds,” but the true cause is much more fundamental and homemade.

A roadmap for the new China

Navigating this landscape requires a radical departure from the strategies of the last decade. Here is a roadmap for brands to survive the normalization:

First, stop chasing volume at all costs. You cannot discount your way out of a maturity crisis. Discounts are always an easy growth trap, destroying brand equity over time. Brands must pivot to value creation, and that starts with addressing the fundamentals now. China is the country of speed; a wait-and-see approach means you will be gone in no time. If your brand is not being perceived as an investment asset and in tune with culture, you are selling a liability.

Second, audit your value deficit. Chinese clients are among the most discerning in the world. If you raised prices by 50% over the past two to three years but didn’t improve the product quality and service experience by at least 70%, you have a value deficit. You must close this gap immediately through hyper-physical experiences.

Third, localize or lose. Cultural respect is the new currency. This goes beyond Lunar New Year capsules, requiring a distinct brand narrative that honors Chinese heritage while maintaining core brand codes.

Fourth, target your VICs (Very Important Clients) with extreme care. With the aspirational market on pause, the top 1% is the only safety net. But they are bored by mediocrity. They need money-can’t-buy experiences, not just another VIP room.

China is far from finished — it is just growing up. Brands that want to level up and create extreme value in this sophisticated market will thrive. Those waiting for the party of 2021 to return will find themselves alone in the dark.

This is an opinion piece originally published in Jing Daily by Daniel Langer, CEO of Équité, recognized as one of the “Global Top Five Luxury Key Opinion Leaders,” and advisor to some of the most iconic luxury brands in the world. He serves as an executive professor of luxury strategy and pricing at Pepperdine University in Malibu and as a professor of luxury at NYU, New York. Daniel has authored best-selling books on luxury management in English and Chinese, and is a respected global keynote speaker.

Daniel conducts in-person masterclasses on various luxury topics across the world. As a luxury expert featured on Bloomberg TV, Forbes, The Economist, and others, Daniel holds an MBA and a Ph.D. in luxury management and has received education from Harvard Business School.